Obtaining a bank's routing transit number (RTN) is essential for transferring funds electronically. Knowing how to locate this crucial identifier ensures smooth and accurate transactions.

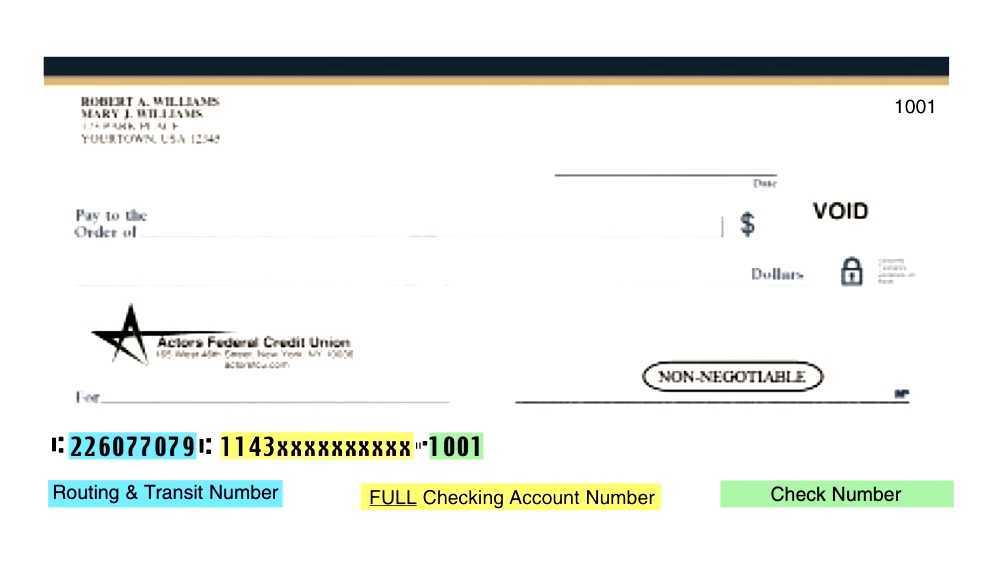

The routing transit number, often abbreviated as RTN, is a nine-digit numerical code uniquely identifying a financial institution's account. This code facilitates the secure transfer of money between banks and financial institutions. To locate this number, access the institution's website. A dedicated page typically details important account information, including the specific RTN. Alternatively, check account statements or contact customer service representatives. Bank branches can also provide this number directly. An example of an RTN might be 123456789.

The RTN's importance stems from its role in enabling electronic funds transfers. Without this unique identifier, financial institutions cannot properly route payments, potentially leading to delays, errors, or even the loss of funds. This accuracy and efficiency are critical in today's fast-paced financial world. Accurate transactions can be important for maintaining good credit rating and for business continuity. Furthermore, having a reliable and up-to-date RTN streamlines the processing of payments like checks, wires, and electronic transfers.

Locating this nine-digit code, or RTN, becomes a foundational step in various financial processes. Understanding these steps can save time and mitigate errors during money transfers.

Finding Routing Transit Numbers

Accurate retrieval of routing transit numbers (RTNs) is essential for seamless electronic fund transfers. Proper identification ensures the smooth processing of transactions.

- Bank website

- Account statements

- Customer service

- Online banking portals

- Branch locations

- Payment platforms

Locating an RTN often involves consulting multiple resources. Bank websites are frequently the primary source, providing readily available details. Account statements, a secondary source, typically list this critical information. Customer service representatives are available to answer queries. Online banking portals frequently include this data. Branch locations can also assist. Payment platforms might require the RTN for direct transfers. By considering these interconnected avenues, obtaining the necessary nine-digit code for accurate financial transactions becomes straightforward. For instance, a business transferring funds to a vendor will need the vendor's RTN for successful ACH or wire transfers. Similarly, personal transfers between individuals often rely on providing the recipient's bank RTN, ensuring accurate deposit of funds.

1. Bank website

A bank's website serves as a primary repository for crucial financial information, including routing transit numbers (RTNs). The accessibility and organization of this data on the website facilitate quick and accurate retrieval. The design of a dedicated online portal or account section within the site often simplifies the process. Clear labeling and easy navigation within the website structure are crucial for users to locate the specific page containing RTNs.

Numerous real-life examples illustrate the reliance on bank websites for this information. For example, businesses frequently utilize a bank's website to verify RTNs before initiating electronic funds transfers to vendors. Similarly, individuals seeking to transfer money between accounts often find this data conveniently displayed on their online banking platform. The provision of RTNs directly on the bank's website reduces reliance on alternative methods like contacting customer service, thus streamlining the process and enhancing efficiency. Furthermore, the updated RTN information on the website ensures that the details are current and appropriate for immediate use.

In conclusion, the bank's website plays a critical role in acquiring RTNs. Efficient design and clear presentation within the website structure significantly impact the ease and speed of obtaining this vital financial information. This accessibility reduces administrative burden and enhances overall transactional efficiency, contributing to a smoother and more dependable financial experience for users across various transactions, from personal transfers to business dealings.

2. Account statements

Account statements serve as a crucial resource for locating routing transit numbers (RTNs). They frequently contain this essential nine-digit code, providing a readily available reference for financial transactions. The inclusion of the RTN on statements facilitates accurate and prompt electronic transfers, payments, and other financial operations. Accurately identifying the RTN is imperative for seamless transactions.

The presence of the RTN on account statements simplifies the process of identifying the necessary code for electronic fund transfers. This readily available information minimizes the need for contacting customer service or consulting other resources. Furthermore, account statements often include the bank's name and address, enhancing the accuracy of the identified number, which is a critical element when dealing with multiple accounts or financial institutions. The structured format of account statements often places the RTN in a dedicated field, making retrieval straightforward. This feature, present in most banking systems, reduces potential errors and the search time required to ascertain the RTN.

In summary, account statements offer a direct and dependable method for obtaining RTNs. Their structured format, including explicit RTN placement, underscores their importance as a primary source for this information. The availability of this critical data on statements streamlines financial processes and reduces potential errors associated with manual searches or reliance on external inquiries. This direct approach enhances the efficiency and accuracy of financial transactions, highlighting the practical significance of account statements in managing financial operations.

3. Customer service

Customer service representatives (CSRs) play a vital role in acquiring routing transit numbers (RTNs). Direct communication with CSRs provides a direct and often immediate means of obtaining this essential nine-digit code. The accessibility of qualified personnel facilitates verification and resolution of queries, ensuring correct RTNs for financial transactions. This direct interaction mitigates potential errors inherent in alternative methods. Errors in RTNs can lead to delays or incorrect processing of funds, highlighting the importance of accurate information from customer support channels. In scenarios involving complex or unusual circumstances, CSRs offer personalized support to locate RTNs. Complex situations may include inquiries regarding different account types or specific transaction needs.

Real-life examples underscore the practical significance of customer service in this context. A business transferring funds to a supplier may encounter difficulties if the supplier's RTN is incorrect. Prompt access to a knowledgeable CSR would rectify any inaccuracies, preventing delays and potentially significant financial losses. Similarly, individuals conducting personal transfers often rely on CSR assistance when faced with issues regarding RTN retrieval. This support fosters trust and confidence in financial processes. In situations where online resources are inaccessible or insufficient, CSRs provide a vital support structure. This responsiveness ensures the smooth and accurate execution of financial transactions regardless of the complexity of the transaction or the user's familiarity with online systems.

In conclusion, customer service representatives are critical intermediaries for acquiring routing transit numbers. Their expertise and direct interaction facilitate accurate retrieval, mitigating potential errors and ensuring seamless financial transactions. The value of readily available customer service support is paramount for both businesses and individuals. This underscores the crucial role of comprehensive support channels in the context of financial operations.

4. Online banking portals

Online banking portals offer a convenient and readily accessible means for users to retrieve routing transit numbers (RTNs). The integration of this functionality within these platforms streamlines the process of accessing essential financial information, reducing reliance on alternative methods.

- Direct Access to Account Information

Many online banking platforms feature dedicated sections for account details. These sections often display the RTN prominently, allowing users to locate it quickly and effortlessly. This direct access contrasts with methods that necessitate contacting customer service or retrieving physical statements. This direct access is particularly crucial for electronic fund transfers, allowing for prompt and accurate transactions. The convenience of this design facilitates quick and straightforward access for both individuals and businesses needing this information.

- Integration with Transactional Tools

Certain online banking platforms seamlessly integrate RTNs into transaction tools. This integration allows users to effortlessly include the required RTN when initiating transfers or other financial operations. For instance, some platforms automatically populate the RTN field when selecting recipients or specific accounts. This automation streamlines the process and reduces the likelihood of errors. This integration significantly enhances the speed and efficiency of financial transactions. This automated system helps to maintain the accuracy of the RTN within financial transactions.

- Security Protocols and Data Validation

Secure access through online banking portals is critical for retrieving sensitive information like RTNs. Robust security measures protect users from unauthorized access to account data, safeguarding the financial integrity of accounts. Data validation within the platform ensures the accuracy of displayed RTNs, which is essential for avoiding errors in transactions. This validation process offers enhanced security and reliability when handling financial data. The platform's commitment to security practices underscores the importance of safeguarding account details.

- Accessibility and Convenience

Online banking portals facilitate 24/7 access to RTNs, accommodating user schedules. This extended accessibility contrasts with the limitations of traditional methods, such as limited branch hours or statement delivery. The convenience of this round-the-clock availability enhances financial flexibility. This feature aligns with the demands of modern financial management, where users expect immediate access to financial data, regardless of time constraints. The ease of retrieval in a convenient manner is a significant advantage.

Online banking portals provide a comprehensive and centralized approach to retrieving routing transit numbers. The combination of direct access, transactional integration, security protocols, and accessibility enhances the overall user experience and ensures the accuracy of financial transactions. The convenience and security offered by online banking portals significantly streamline the process of acquiring RTNs, making them a crucial element in modern financial management.

5. Branch Locations

Branch locations remain a viable method for acquiring routing transit numbers (RTNs). Direct interaction with staff at physical bank branches offers a straightforward means of obtaining this critical nine-digit code. The presence of knowledgeable personnel at branch locations allows for immediate verification and resolution of inquiries regarding RTNs, particularly beneficial for individuals unfamiliar with online banking or those requiring immediate access to this information. The physical presence of staff facilitates personalized assistance, ensuring accuracy and promptness in retrieving the required details. In scenarios where online resources prove inaccessible or inadequate, branch locations offer a crucial backup option for obtaining RTNs.

Real-world examples demonstrate the practical application of this method. Businesses needing to initiate wire transfers may find branch staff invaluable in securing the precise RTNs for their vendors. Individuals managing numerous accounts or those encountering technical difficulties with online platforms often find direct interaction with branch personnel more efficient for acquiring RTNs. Similarly, those unfamiliar with the intricacies of online banking systems or with limited digital access may find a branch location a more convenient and accessible solution. This personalized approach is crucial in scenarios involving sensitive or complex financial transactions. The ability to personally verify the RTN's accuracy with a branch employee before initiating transactions underscores the value of this approach.

In conclusion, branch locations maintain a significant role in the process of acquiring routing transit numbers. The direct interaction with knowledgeable staff provides a reliable source of this information, especially in situations requiring immediate access, personal verification, or overcoming technological limitations. The availability of branch locations offers a vital component in the overall framework for obtaining RTNs, thereby supporting the wider ecosystem of financial transactions.

6. Payment platforms

Payment platforms, encompassing diverse online and mobile services, often necessitate the use of routing transit numbers (RTNs). Understanding the interplay between these platforms and RTNs is crucial for efficient and accurate transactions. The integration of RTNs within payment platforms directly affects the routing and processing of funds.

- Direct Integration and Data Exchange

Many payment platforms directly integrate with banking systems. This integration enables seamless data exchange, including the retrieval and validation of RTNs. The platform facilitates the inclusion of the recipient's RTN during the transfer process, ensuring correct routing. This direct interaction eliminates the need for manual input by users, thereby minimizing errors.

- Automated RTN Lookup

Sophisticated payment platforms often feature automated RTN lookup functionalities. Users provide the recipient's name and account details, and the platform automatically identifies and verifies the corresponding RTN. This automation minimizes errors and streamlines the process. Real-world examples include peer-to-peer money transfer applications and online payment portals for businesses, where the accurate retrieval of RTNs is vital.

- Error Prevention and Enhanced Security

Payment platforms employing robust RTN validation mechanisms can help mitigate errors during transfers. The platform's checks for valid RTNs prevent transactions from being routed incorrectly or rejected. This validation process contributes to the security of funds, reducing the risk of fraudulent activities. A platform's ability to correctly match an RTN to an account enhances the overall security and reliability of payment services.

- Facilitating International Transactions

Some payment platforms cater to international transactions, requiring specific RTNs or bank codes for cross-border payments. The platform assists users in identifying the correct RTNs for international transfers, ensuring accurate processing of funds across borders. This feature is essential in facilitating international commerce and personal financial exchanges, guaranteeing successful transactions between different countries and financial systems.

In summary, payment platforms play a significant role in the process of obtaining routing transit numbers. Through integrated systems, automated lookups, enhanced security, and support for international transactions, platforms streamline the identification and use of RTNs, facilitating precise and secure transfers. The convenience and accuracy provided by these platforms are crucial aspects of modern financial transactions. The sophisticated functionality within these platforms reduces the user's burden in this process, improving efficiency and financial reliability.

Frequently Asked Questions about Finding Routing Transit Numbers

This section addresses common inquiries regarding the retrieval of routing transit numbers (RTNs). Accurate RTN information is essential for smooth and secure financial transactions.

Question 1: Where can I find my routing transit number (RTN)?

Routing transit numbers are typically available on various resources. Bank websites often provide this information directly within online banking portals or account management sections. Alternatively, account statements or official correspondence, such as bills or receipts, may contain the RTN. Contacting customer service representatives or visiting a physical branch location are additional avenues for obtaining this crucial code.

Question 2: Why is my routing transit number important?

The routing transit number (RTN) serves as a unique identifier for a financial institution's account. This code facilitates the secure and efficient routing of funds between different financial institutions, ensuring that payments reach their designated destinations correctly. Without a valid RTN, transactions may experience delays, be rejected, or even be lost.

Question 3: How many digits does a routing transit number (RTN) contain?

A standard routing transit number (RTN) consists of nine digits. This consistent format is crucial for accurate processing and routing of financial transactions.

Question 4: What should I do if I cannot locate my routing transit number?

If the routing transit number (RTN) cannot be located on readily available resources, contacting the financial institution's customer service department is recommended. Representatives can provide the necessary information to ensure accurate processing of future transactions.

Question 5: How can I avoid errors when using routing transit numbers?

Double-checking the accuracy of the routing transit number (RTN) before initiating any transfer is crucial. Carefully verifying the displayed number against the information on statements or the bank's website can prevent errors. Ensuring the correct account number for the recipient is equally important for secure transfers.

Understanding the various methods for obtaining routing transit numbers (RTNs) is critical for maintaining the smooth operation of financial transactions. Accuracy and promptness in retrieving this code are vital components of responsible financial management.

This concludes the FAQ section. The following section will explore the practical application of routing transit numbers in real-world financial scenarios.

Conclusion

Obtaining routing transit numbers (RTNs) is a fundamental aspect of secure and efficient financial transactions. This comprehensive exploration has outlined various avenues for acquiring these critical nine-digit codes. Key methods include accessing bank websites, reviewing account statements, contacting customer service representatives, utilizing online banking portals, consulting branch locations, and leveraging payment platforms. Each approach offers unique advantages in terms of accessibility, immediacy, and security protocols. The choice of method depends on individual circumstances, including access to technology, desired level of immediate support, and the nature of the financial transaction. Regardless of the chosen method, accurate retrieval of RTNs is crucial for ensuring the successful execution of electronic fund transfers, payments, and other financial operations.

Accurate and timely access to RTNs is essential in today's interconnected financial world. The methods outlined provide a practical framework for acquiring these codes across various contexts, from personal transactions to complex business dealings. Maintaining accuracy in RTNs safeguards against errors, delays, and potential financial losses. Proactive steps in obtaining and verifying this crucial information are an integral part of sound financial management.

You Might Also Like

Stunning Medium Length Hairstyles: Pictures & IdeasKrispy Kreme Owner Net Worth: A Deep Dive Into Their Fortune

Hugh O'Brian's Cause Of Death Revealed

Miranda Frigon: Expert Tips & Tricks!

New Huntsville, AL Restaurants 2024: Hottest Spots!

Article Recommendations

- Md Construction Services Building Dreams With Expertise

- Insights On Darren Criss Age A Captivating Look At His Life And Career

- The Life And Influence Of Chris Griffin A Detailed Examination