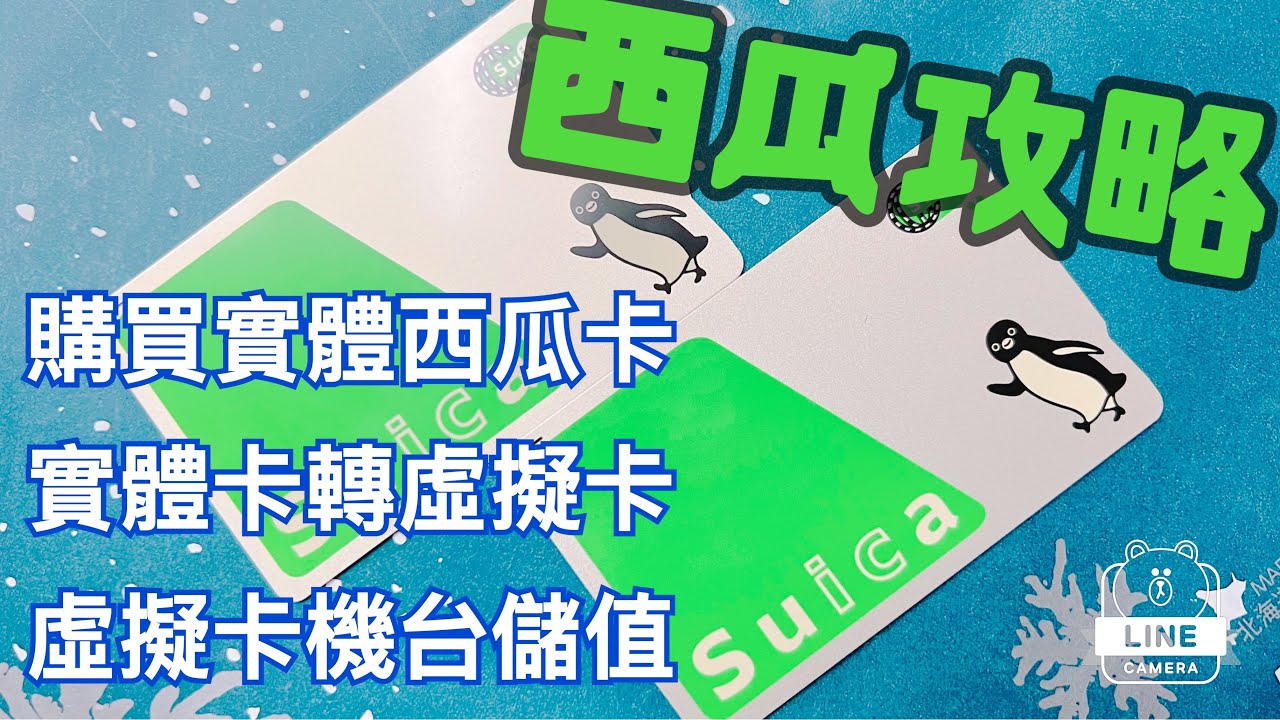

Virtual cards are a type of payment card that is not physically present. Instead, they are stored electronically on a device, such as a smartphone or computer. Virtual cards can be used to make purchases online or over the phone, and they offer a number of benefits over traditional plastic cards.

One of the main benefits of virtual cards is that they are more secure than traditional plastic cards. Virtual cards are not linked to a physical account, so if they are lost or stolen, the thief cannot access your funds. Additionally, virtual cards can be used to make one-time purchases, which can help to reduce the risk of fraud.

Virtual cards are also more convenient than traditional plastic cards. They can be stored on a device that you always have with you, so you don't have to worry about forgetting your card at home. Additionally, virtual cards can be used to make purchases from anywhere in the world, which can be helpful if you are traveling.

Virtual cards are a safe, convenient, and versatile payment option. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments.

Virtual Cards

Virtual cards are a type of payment card that is not physically present. Instead, they are stored electronically on a device, such as a smartphone or computer. Virtual cards can be used to make purchases online or over the phone, and they offer a number of benefits over traditional plastic cards.

- Secure

- Convenient

- Versatile

- One-time use

- Global acceptance

- Easy to manage

- Cost-effective

- Environmentally friendly

Virtual cards are a safe, convenient, and versatile payment option. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments. For example, virtual cards can be used to make purchases from anywhere in the world, which can be helpful if you are traveling. Additionally, virtual cards can be used to make one-time purchases, which can help to reduce the risk of fraud.

1. Secure

Virtual cards are more secure than traditional plastic cards because they are not linked to a physical account. This means that if a virtual card is lost or stolen, the thief cannot access your funds. Additionally, virtual cards can be used to make one-time purchases, which can help to reduce the risk of fraud.

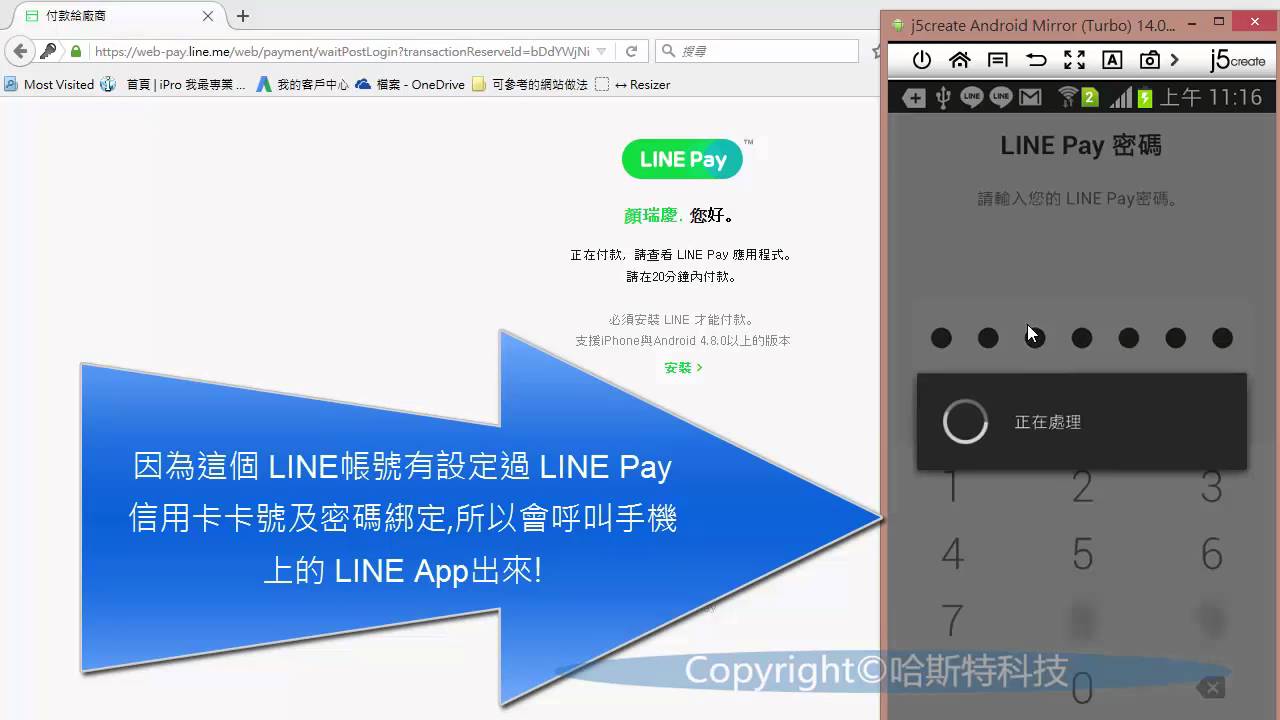

For example, let's say you are shopping online and you want to use a virtual card. You can create a virtual card with a specific spending limit, and once you have made your purchase, the virtual card will be closed. This helps to protect you from fraud because even if your virtual card information is stolen, the thief will not be able to use it to make additional purchases.

Virtual cards are a safe and convenient way to make payments. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments.

2. Convenient

Virtual cards are more convenient than traditional plastic cards because they can be stored on a device that you always have with you, such as a smartphone or computer. This means that you don't have to worry about forgetting your card at home or carrying around a bulky wallet.

For example, let's say you are going to the grocery store. You can simply open up your virtual card app on your smartphone and scan your phone at the checkout counter. You don't have to worry about fumbling around for your wallet or remembering your PIN number.

Virtual cards are also convenient because they can be used to make purchases from anywhere in the world. This is helpful if you are traveling or if you want to buy something from an online store that is not based in your country.

Overall, virtual cards are a convenient and easy way to make payments. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments.

3. Versatile

Virtual cards are versatile because they can be used for a wide range of purposes. They can be used to make purchases online, over the phone, or in person. Virtual cards can also be used to make one-time purchases, recurring payments, or subscriptions.

- Online purchases: Virtual cards can be used to make purchases from any online store that accepts credit cards. This is convenient because you don't have to enter your credit card information every time you make a purchase.

- Phone purchases: Virtual cards can also be used to make purchases over the phone. This is helpful if you are ordering something from a company that does not have an online store.

- In-person purchases: Virtual cards can be used to make in-person purchases using a mobile payment app. This is convenient because you don't have to carry around your physical credit card.

- One-time purchases: Virtual cards can be used to make one-time purchases, such as when you are buying something from a website that you don't trust. This helps to protect your financial information.

- Recurring payments: Virtual cards can also be used to make recurring payments, such as for a subscription service. This is convenient because you don't have to remember to make the payment each month.

Overall, virtual cards are a versatile payment option that can be used for a wide range of purposes. They are convenient, secure, and easy to use.

4. One-time use

One-time use virtual cards are a type of virtual card that can only be used once. This makes them ideal for making purchases from websites or businesses that you don't trust, or for making online purchases where you don't want to store your credit card information.

When you create a one-time use virtual card, you specify the spending limit and the merchant that you want to use it with. Once you have made your purchase, the virtual card will be closed and cannot be used again.

One-time use virtual cards are a safe and convenient way to make online purchases. They offer a number of benefits over traditional plastic cards, including:

- Security: One-time use virtual cards are more secure than traditional plastic cards because they are not linked to your physical credit card account. This means that if your virtual card is lost or stolen, the thief cannot access your funds.

- Convenience: One-time use virtual cards are convenient because they can be created and used instantly. You don't have to wait for a physical card to be mailed to you, and you don't have to worry about carrying around your physical credit card.

- Control: One-time use virtual cards give you more control over your spending. You can specify the spending limit and the merchant that you want to use the card with, so you don't have to worry about overspending or unauthorized purchases.

One-time use virtual cards are a valuable tool for online shoppers. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make secure and convenient online purchases.

5. Global acceptance

Virtual cards are accepted by merchants all over the world, making them a convenient and versatile payment option for international travelers. Whether you're shopping online or in person, you can use your virtual card to make purchases with confidence, knowing that it will be accepted.

- Convenience: Virtual cards are easy to use and can be accepted anywhere that accepts credit cards. This makes them a convenient option for travelers who don't want to carry around multiple currencies or worry about exchange rates.

- Security: Virtual cards are more secure than traditional credit cards because they are not linked to your physical account. This means that if your virtual card is lost or stolen, your funds are protected.

- Control: Virtual cards give you more control over your spending. You can set spending limits and track your transactions online, so you can stay on top of your finances while you're traveling.

- Cost-effective: Virtual cards can save you money on foreign transaction fees. When you use a traditional credit card to make a purchase in a foreign currency, you may be charged a fee of up to 3%. However, virtual cards typically do not charge foreign transaction fees.

Overall, virtual cards are a safe, convenient, and cost-effective way to make payments while traveling. They are accepted by merchants all over the world, and they offer a number of benefits over traditional credit cards.

6. Easy to manage

Virtual cards are easy to manage because they can be stored and accessed electronically. This means that you don't have to worry about losing your card or having it stolen. You can also easily track your spending and set spending limits using your virtual card provider's online portal or mobile app.

The ease of managing virtual cards makes them a great option for people who want to have more control over their finances. Virtual cards can also be helpful for people who travel frequently or who shop online a lot. By using a virtual card, you can avoid the risk of losing your physical card or having your card information stolen.

Here are some of the benefits of using a virtual card:

- Easy to track your spending: Virtual card providers typically offer online portals or mobile apps that allow you to track your spending in real time. This can help you stay on top of your finances and avoid overspending.

- Set spending limits: Virtual card providers also allow you to set spending limits on your cards. This can help you control your spending and avoid debt.

- Freeze or cancel your card instantly: If you lose your virtual card or if it is stolen, you can freeze or cancel it instantly using your virtual card provider's online portal or mobile app. This can help protect your funds.

Virtual cards are a safe, convenient, and easy-to-manage payment option. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments.

7. Cost-effective

Virtual cards are a cost-effective payment option because they can help you save money on fees and interest charges. For example, many virtual card providers do not charge foreign transaction fees, which can save you money if you are traveling or shopping online from international retailers.

Additionally, virtual cards can help you avoid late payment fees and overdraft fees. This is because you can set up automatic payments for your bills using your virtual card. This ensures that your bills are paid on time, even if you forget or are unable to make the payment manually.

Overall, virtual cards are a cost-effective payment option that can help you save money on fees and interest charges. They are a great option for people who want to save money on their finances.

8. Environmentally friendly

Virtual cards are environmentally friendly because they eliminate the need for physical plastic cards, which are made from PVC, a non-biodegradable material. Additionally, virtual cards reduce the need for paper statements and receipts, which can save trees and reduce landfill waste.

- Reduced plastic waste: Virtual cards eliminate the need for physical plastic cards, which are made from PVC, a non-biodegradable material. This helps to reduce plastic waste and pollution.

- Reduced paper waste: Virtual cards reduce the need for paper statements and receipts, which can save trees and reduce landfill waste. Many virtual card providers offer online statements and receipts, which can be accessed electronically.

- Reduced carbon emissions: Virtual cards can help to reduce carbon emissions by eliminating the need for physical cards to be shipped and by reducing the need for paper statements and receipts to be printed and mailed.

Overall, virtual cards are a more environmentally friendly payment option than traditional plastic cards. They help to reduce plastic waste, paper waste, and carbon emissions.

Virtual Card FAQs

Virtual cards are a safe, convenient, and versatile payment option. They offer a number of benefits over traditional plastic cards, including increased security, reduced risk of fraud, and easy management. However, there are also some common questions and concerns about virtual cards that potential users may have.

Question 1: Are virtual cards safe?

Yes, virtual cards are safe to use. They are more secure than traditional plastic cards because they are not linked to your physical account. This means that if your virtual card is lost or stolen, the thief cannot access your funds.

Question 2: Are virtual cards accepted everywhere?

Virtual cards are accepted by merchants all over the world, both online and in person. However, there may be some smaller merchants or businesses that do not yet accept virtual cards. You can check with the merchant before making a purchase to see if they accept virtual cards.

Question 3: Are there any fees associated with using virtual cards?

Some virtual card providers may charge a small fee for using their services. However, many virtual card providers do not charge any fees. You should check with your virtual card provider to see if there are any fees associated with using their services.

Question 4: Can I use virtual cards to make international purchases?

Yes, you can use virtual cards to make international purchases. Virtual cards are accepted by merchants all over the world. However, you should check with your virtual card provider to see if there are any fees associated with making international purchases.

Question 5: How do I get a virtual card?

You can get a virtual card from a number of different providers. Some banks and credit unions offer virtual cards to their customers. You can also get a virtual card from a number of online providers. Once you have found a virtual card provider, you will need to create an account and provide some basic information. Once your account is created, you can start using your virtual card to make purchases.

Question 6: What are the benefits of using virtual cards?

There are a number of benefits to using virtual cards, including:

- Increased security

- Reduced risk of fraud

- Easy management

- Convenience

- Versatility

- Cost-effectiveness

- Environmental friendliness

Overall, virtual cards are a safe, convenient, and versatile payment option. They offer a number of benefits over traditional plastic cards, and they are becoming increasingly popular as a way to make payments.

Transition to the next article section:

Now that you know more about virtual cards, you can start using them to make safe and convenient purchases. Virtual cards are a great way to manage your finances and protect your identity. If you have any other questions about virtual cards, please contact your virtual card provider.

Virtual Card Tips

Virtual cards are a safe, convenient, and versatile payment option. They offer a number of benefits over traditional plastic cards, including increased security, reduced risk of fraud, and easy management. Here are a few tips to help you get the most out of your virtual cards:

Tip 1: Use virtual cards for online purchases.

Virtual cards are a great way to make online purchases because they are more secure than traditional credit cards. When you use a virtual card, you don't have to enter your credit card number or other personal information on the merchant's website. This reduces the risk of your information being stolen or compromised.

Tip 2: Use virtual cards for recurring payments.

Virtual cards are also a great way to make recurring payments, such as for subscriptions or monthly bills. This is because you can set a spending limit on your virtual card, so you don't have to worry about overspending. Additionally, you can easily cancel your virtual card if you no longer need it.

Tip 3: Use virtual cards for international travel.

Virtual cards are a great option for international travel because they are accepted by merchants all over the world. Additionally, virtual cards typically do not charge foreign transaction fees, which can save you money.

Tip 4: Use a virtual card provider that offers strong security features.

When choosing a virtual card provider, it is important to choose one that offers strong security features, such as fraud protection and encryption. This will help to protect your personal information and your funds.

Tip 5: Monitor your virtual card transactions regularly.

It is important to monitor your virtual card transactions regularly to ensure that there is no unauthorized activity. You can typically do this by logging into your virtual card provider's online portal or mobile app.

By following these tips, you can use your virtual cards safely and securely to make purchases online, pay bills, and travel the world.

Summary of key takeaways or benefits:

- Virtual cards are more secure than traditional credit cards.

- Virtual cards can help you avoid fraud.

- Virtual cards are convenient and easy to use.

- Virtual cards are accepted by merchants all over the world.

- Virtual cards can help you save money.

Transition to the article's conclusion:

Overall, virtual cards are a great payment option for people who want to make safe and convenient purchases. By following the tips in this article, you can get the most out of your virtual cards.

Conclusion

Virtual cards are a safe, convenient, and versatile payment option that offer a number of benefits over traditional plastic cards. They are more secure because they are not linked to your physical account, and they can be used to make one-time purchases or recurring payments. Virtual cards are also accepted by merchants all over the world, and they can help you save money on fees and interest charges.

As the world increasingly moves towards digital payments, virtual cards are becoming more and more popular. They offer a number of advantages over traditional plastic cards, and they are a great way to manage your finances and protect your identity.

You Might Also Like

Explore Humana CareSource: Your Guide To Comprehensive HealthcareThe Ultimate Guide To HX90G: Unlocking Enhanced Performance

Discover The Best Audi Beverly Hills Has To Offer

The Ultimate Guide To DCD6 Amazon: Discover The Best Deals And Reviews

Uncover The Secrets Of Phillipmartin: Insights And Expertise

Article Recommendations

- Unveiling The Fascinating World Of Kyrk A A Comprehensive Insight

- Unveiling The Fascinating World Of The Caine Bird

- The Art And Strategy Behind Piano Advertisement Capturing Attention And Inspiring Music Enthusiasts